The Basics: What You Need to Know About Insurance On and In Your Owner Occupied Condominium or Townhouse

Understanding the Building Blocks of Insurance and Risk Reduction*

As a prudent part of your investment, you need to place insurance – in addition to that provided by the association policies – on your Condominiums & Town Homes. This is important for several reasons, including . . . .

- You do not have any individual property protection under the Homeowners’ Association’s (HOA) policies, other than what they grant to you. The “Named Insured” under the policy is the Association – not you individually – and as such your benefits under the HOA’s policy are limited to what the HOA’s policy covers.

Typically, the HOA’s policies are not going to repair the interiors of your home. They will stop at the fire wall or perhaps come in as far as the dry wall, but generally that is as far as the HOA will go. You need coverage for your own interior and asset protection: Structure, personal contents, loss of use, and loss assessment.

- For the same reasons as the property, you do not have any individual, personal liability protection provided by the HOA; the liability protection is for the common area only. You have a personal exposure to injury to people or their property that should be covered by your own insurance. And, in order to obtain an Umbrella insurance policy, you’ll need to have this basic liability insurance part in place.

Here’s what you want to look for in placing coverage on Condominium & Town Homes:

- “Dwelling”/Unit Owners Additions: Protects the interior walls and structures – inside the fire walls – of your unit for special damages, including Fire, Water Damage, Vandalism, etc. Minimum Recommended Limits are $50,000 or $80 a square foot in value.

Referred to, by lenders, as “Hazard Insurance”, this is essentially insurance coverage that extends to the physical interior structure for most types of damage. Always purchase, when possible, the Broad or Special Form contracts. Broad form is a specifically enumerated cause of loss contract, whereas Special Form covers all damage to your home except for what is specifically excluded or limited as found in the policy’s contract.

Coverage exclusions for both forms include (but are not limited to) damage caused by an Earthquake, a Flood, occasionally Theft of Building items, Wear & Tear, Vacancy, Mold and other Bio Agents, animals (including rodents, birds, etc.), War, Illegal, and Intentional acts.

- Loss of Use of the Premises: Make sure the coverage provided is enough to let you temporarily rent another place while your unit is being repaired following an insured damage claim. This policy coverage provides for your economic loss following a fire; this protection is called Loss of Use (also called additional living expenses). This coverage is intended to provide you with funds to pay for temporary or longer term housing while your home is being repaired. It also covers the additional costs of living beyond basic shelter; for instance, in the first few weeks following a devastating fire, you’ll be eating out and not preparing your own meals.

The amount of coverage for this varies, from insurer to insurer. It is often an additional limit of 20% of the dwelling (Coverage A) limit, but some companies make it an open number, referring to it as Actual Loss Sustained; typically, Safeco makes it a 24-month Actual Loss Sustained coverage . An important aspect of this coverage is that generally it will run out after a 12-month period from the date of the fire. Some companies will provide up to 24 months; it’s always good to ask your agent about this as it is not unusual for a total loss rebuilding project to take more than one year.

- Personal Contents: Your personal property inside the condominium is not covered by the association, so you’ll want to provide coverage for these items, including itemizing possessions of high or unique value such as Jewelry, Silver/ Gold/Pewter wares, Coins, Guns, special Art items, and Furs.

Contents coverage, provides protection for loss or damage to your personal belongings. The kinds of insurable damage that are covered are generally spelled out, what we call named causes of loss (similar to the Broad Form dwelling form); these include Fire and Theft damage among other causes. While homeowners’ forms generally also provide for Replacement Cost of damaged personal property, some types of property claims adjustments are limited to Actual Cash Value (rugs, for instance).

Other types of personal property are limited as to the maximum allowable limit of coverage – items such as Jewelry, Money, Gold, breakables, Computers, etc.). Please see the attached Protection Alert brief for a larger discussion.

- Personal Liability: This part of the policy provides for your PersonalLiability coverage, to protect and defend you against Bodily Injury or Property Damage claims and lawsuits from another person, resulting from your ownership of the property or from your personal activities and for which you are held liable. This liability protection follows you for personal, non-business exposures wherever you go, world-wide!

We strongly recommend a minimum of $500,000 personalliability protection. Often, more aggressive agents will offer $300,000 in coverage; they think it will make the difference in your buying their insurance, as it will appear less expensive. But, truly, the additional cost to upgrade to $500,000 is about the same as a fast-food meal for two. Knowing that, why wouldn’t you buy the extra protection?

Often, the personal liability protection will include Personal Injury coverage, but always ask to make it a part of the policy, just to be certain. Personal injury protects you in the event you are sued for slander or a bevy of other alleged infringements that do not involve actual bodily injury. In today’s suit-happy society, you need as much protection as possible.

Another thought about personal liability protection: People love animals, generally speaking. Most insurance companies will have a coverage exclusion if you have a breed of a dog (or a mixed breed) that is designated to be a potentially vicious breed. Generally speaking, these are pit bulls and mastiffs, but there are other breeds that may be excluded, depending upon a particular insurance company’s contract or upon a municipality’s designation. So, be certain that you choose either an acceptable breed of dog or use an insurance company that doesn’t have any animal exclusions.

Tip: If you already have a dog (you are never going to give up) but it is unacceptable to your insurance company, there are programs popping up all the time which will accept generally prohibited breeds of dogs. There is a solution, so don’t drop your dog off at the local shelter; simply get an additional policy.

- Medical Payments to Others. Severe bodily injury claims will be covered under the Personal Liability section of your policy. Medical Payments is intended to offer small payments for injuries (your guest twisted her ankle on your step) so as to avoid larger claims. So, you will see small coverage limits applied to this coverage section. Always contact your agent if someone is hurt on your property; the company will adjust the claim accordingly!

- Assessments:This protection is not unique to condos & town homes, although it is usually thought of as such. This coverage provides protection when your HOA causes an assessment to the members of the HOA resulting from inadequate insurance obtained by the association – liability or property assessments. You should have no less than $50,000 coverage.

- And remember, Earthquake & Flood insurance are extra and not a part of a regular insurance policy. These are additional coverages; ask your agent about them.

Each and every association is a little different, but these recommended coverages will assist you in providing a policy that will protect your interests in preserving the asset value of your property. Please refer to the Association’s CC&Rs and its By-Laws for more exact coverage restrictions, and try out this question on the management company:

“The water line, connected to my washing machine, broke and water ran everywhere. It caused damage to my unit and to the adjacent unit. The Damages included my floor, cabinets, walls, the floor and ceiling between the adjacent (or downstairs) unit, and of course there is damage to the common structure. What damages will be covered by the association’s insurance? What is my responsibility under the association’s policy, the CC&Rs, and the By-Laws?” It’s the question property managers hate most!

*This dialogue on Condominium insurance policies is necessarily brief and is not to be interpreted as the final word about condominium or townhouse protection; please refer to your policy for a complete coverage review.

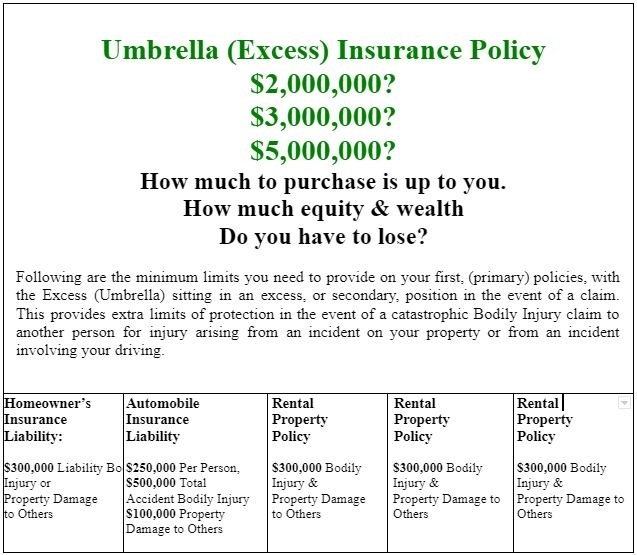

Umbrella (aka: Excess) LiabilityInsurance

An Umbrella Liability policy provides you with protection in addition to what we call your primary limits of coverage: It is a policy of additional insurance, generally written in increments of $1,000,000, in addition to your auto, home and rental insurance policies. The idea here is that rather than a claimant trying to put his hands in your pockets, you want him instead to go after the insurance company’s pocket!

What Does an Umbrella Liability Policy Cover?

This total coverage limit provides you with protection for severe claims for which you may become liable due to bodily injury or property damages to others and which are first covered under your primary limits (your first “layer”) of coverage. Basically, the Umbrella Policy kicks in when a claim exceeds this first layer of protection; it creates an additional layer of protection for claims that exceed those initial policy limits, including the cost of defense that ends when your initial policy’s limits are fully spent.

It is important to ensure that you do not have a gap in your layers of coverage. You must be sure that the limits of the primary policy (the first layer) end where the Umbrella Policy’s layer begins, without a gap in the middle. You want to have your auto, home, and rental insurance liability limits be high enough to flow directly into the umbrella’s layer of coverage.

Tip: Make sure all entities (you and any spouse, trust, or LLC) are listed on your primary and umbrella policies. Not all insurers will do this, and the coverage is not automatic. You must request this additional protection.

It is vital to remember that the Umbrella (Excess) Policy is basically an extension of your home, rental, and auto policies. Generally, Umbrella Policies will not cover actions outside of what the primary policy will cover. Other policy options may be available when such a protection requirement arises.

What Do You Need to Do to Get an Excess Liability Policy?

You generally need primary limits on your auto policies of at least $250,000 per person/$500,000 per occurrence Bodily Injury, $100,000 Property Damage, and $300,000 on your home and rentals before you look to an Umbrella Policy. Then, ask your insurance agent to quote the coverage for you: It is just that simple!

What Does an Umbrella (Excess) Liability Policy Cost?

You have 1 Residence and 2 Cars: The cost can be as low as $325 annually for an Umbrella Liability policy. This cost can be reduced even more if you package your Home, Auto, and Umbrella insurance with one company.

Seldom will two Umbrella policies be the same. Therefore, this discussion of Umbrella insurance is necessarily brief and is not to be interpreted as the final word about Umbrella liability protection; please refer to your policy for complete coverage explanations and always ask questions of your insurance agent to ensure proper protection)

Protection Alert!

Whenever you purchase a homeowner’s insurance policy, you need to be aware that certain types of property are restricted in each and every homeowner’s insurance policy sold in America. We also have written about this in our newsletters & blogs!

Here are a few interesting tips you need to know about some of the limitations to the coverage in a Homeowner’s policy.

- You may wish to enhance your policies by adjusting the sub-limits in your policies for the following items: Jewelry & Furs, Bullion (gold, silver, pewter), Money(including coins and coin collections), Stamp collections,Guns, Securities,and in some cases, Computers, Tools, Oriental Rugs, andBusiness Property(your employer’s or your own).

- Each of these items noted have coverage limitations, ranging from $1,500 – $3,000 (possibly a little more – it varies by company), above which the insurance company will not reimburse you for your loss unless you have adjusted your policy to accommodate for these sub-limits. This can be done either by increasing this sub-limit or by specifically itemizing certain property on your policy and paying an additional premium for it. Often, the combination approach (increasing the sub-limit and itemizing certain pieces) is the best means of properly protecting your valuables.

- Do you operate an additional business, an In-Home Business, from a spare bedroom? You say “No”? According to federal income tax statistics, nearly 10% of all tax-paying Americans have an In-home business operation.

- If you are part of that 10%, we can provide Liability & Propertycoverage for your in-home business; it is done as a rider to your homeowner’s policy or occasionally by a separate policy. You are a part of that 10% if you happen to regularly sell anything out of your home or garage

- If you are operating a business that is run or in which property is stored in your detached garage, the garage and the business property within it are generally excluded from your policy unless the coverage is altered.

- In most cases, an In-Home Business Policy is less expensive than a standard Business Insurance policy, and it fills in some of the gaps of your Homeowner’s insurance policy. What gaps? Your Homeowner’s Policy will not protect a business for property or liability loss that is being operated from home – nor will it protect you unless the policy has been endorsed for the business exposure.

- Earthquake, Flood, and Landslide insurance are additional items, not covered under a homeowner’s policy. Protection for these disasters may be purchased with the policy or separately.

- Homeowner’s policies typically do not extend liability protection to the use of electric bicycles, mopeds, motorized scooters, go-karts, motorized toy cars (Barbie cars), drones, motorboats, and jet skis. This may include rentals; always check with us before you rent these types of motorized toys!

The excluded & limited items in a policy are not be limited to this list, but these are many of the common types of property limited or excluded. Please call us to discuss your policy if you believe you need some special attention to your needs. Or, go online to the MyFreeProtectionReport.com link to see what additional protection you may want or need to discuss.

The cost to adjust your policy, to properly insure these limited coverage items, is not expensive compared to the sizable losses you are self-insuring by not properly covering them under your policies.

If you want to replace these valuable personal items in the event of a theft or other covered loss, and if you want liability insurance to provide additional protection for in-home business activities, you must investigate these additional coverages.

Call us today to review these and other items that may be pertinent to your individual insurance plans.